Sector embarks on a high-risk structural transformation

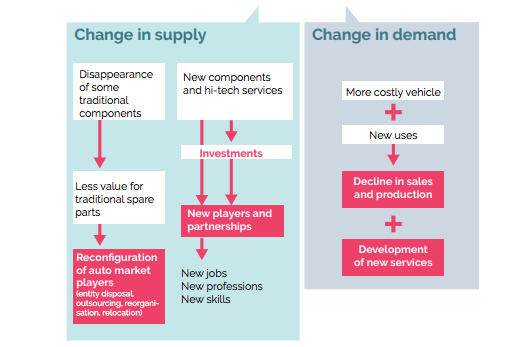

The electric and connected car calls into question the sector’s current structure and value chain, putting traditional players under pressure. Yet, this structural movement comes at a time when changes in demand are underway and a cyclical trough is undermining the automotive sector.

While a brutal collapse of the European or global market is not expected, analysts agree that we shall arrive at the end of a growth cycle by 2020. The post-crisis recovery from 2008 is coming to an end and in Europe the sector is expected to experience positive but weak growth in sales and production in the coming years (less than 1% per year according to the latest IHS estimates). To this cyclical effect, some add new elements forming the initial “ingredients” for a shift in consumer demand, also adding to a change in supply.

DECLINE IN DEMAND

Four elements suggest a change in demand:

- a possible increase in the cost of vehicles and their cost of use due to electrification, regulatory changes and rise in fuel prices subject to global oil prices and/or taxes;

- possible postponements to investments, notably by companies with vehicle fleets, due to a lack of visibility on the options for vehicle use (with the implementation of low-emission zones), or a supply of electric vehicles still insufficiently adapted to their needs (sufficient recharging terminals and battery autonomy);

- development of car sharing which could have real consequences on the number of cars purchased by households;

- expected decline in exports (growth of local production in emerging zones, protectionist policies, depreciation of currencies, etc.), limiting the growth potential of European production.

These trends could be minimized by measures to help households buy “clean” vehicles, such as a scrapping premium or bonus/penalty system... The impact on consumption pattern trends (might only be marginal?) should be monitored, as should the opposite effect of incentives to purchase less polluting vehicles. This said, the end of a cycle does not necessarily mean the end of the automotive industry or the perspective for large-scale social plans. We are, however, more concerned by what is happening within companies and the value chain in terms of supply. Profit warning alerts from German premium manufacturers (such as BMW) or very robust automotive suppliers (like Valeo or Continental) are the first symptoms of anticipated changes in the sector.

DISRUPTIONS

Analysts anticipate that these leading players will experience deep tensions. Car manufacturers will have to adapt to three types of transformation in each of the three pillars of their traditional identity and nature, deemed “essential” at least until now. Engine-wise, the shift towards electric engines may give the advantage to those with a command of batteries (or another clean technology solution which is truly effective and low-cost). It also means the disappearance of components - and therefore less value for engine manufacturers and their subcontractors - as well as the transfer of value to technologically more complex and innovative elements (connectivity, modules associated with autonomous driving). In terms of design and control of the end vehicle, the emergence of connected vehicles with autonomous functions and the overriding importance of electronics and software could move the vehicle’s strategic architecture into the hands of digital players and, at the very least, force manufacturers and automotive suppliers to invest in these areas and to form partnerships. And with regards sales and repairs networks, mobility solutions will significantly change the relationship between clients, car dealerships and garages. The latter two will therefore need to incorporate among their skill set an advisory service on mobility-related uses and services.

SHARE OF THE PIE

Manufacturers and big automotive suppliers — mainly European — risk being superseded by new players who have a command of the new building blocks of the automotive value chain (battery manufacturers — Asian for the most part — or companies specialized in digital and data processing for service platforms) and who want a piece of the pie. To try and keep control over their market share, manufacturers and automotive suppliers will, at the very least, need to heavily invest financial and human resources in these relatively new fields of expertise 3 . Even if this is enough to protect them against newcomers, the effort to be made will place a burden on profitability and return on capital remove... with no guarantee of success. The financial community is by no means mistaken and is reassessing downwards investment in the sector.

CAR SHARING

The market research firm Navigant Research expects 8.1 million people in Europe to be subscribed to a car sharing service by 2026. Ride-hailing services (transportation network companies) are expected to continue experiencing strong growth with a 25% increase per year in Europe. They could represent 11.2 billion rides by 2026.

PARTNERSHIPS

While holding onto market positions will require partnerships, they will also reshuffle the deck of current players’ domination. Partnerships will either take the form of mergers between sector players, and this will mean reorganizations with a view to re-establishing (or improving) financial performance, like the merger between PSA and Opel. Or they will open up to non automotive players, bringing uncertainty about future returns on investment, much the type of issue surrounding a partnership such as the Renault-Nissan-Mitsubishi Alliance and Google.

SEEKING LOWER COSTS

These wide-spanning areas of innovation in powertrain and autonomy will increase costs and subsequently sales prices for consumers who are not necessarily ready to pay more for a car, perhaps encouraging them to adopt other “mobility solutions” and thus lowering sales volumes. In both cases, the value of traditional spare parts and vehicle-related services will decline, along with less development of new programmes. Leading players (manufacturers and big automotive suppliers) will, for some, choose to refocus on the most promising areas for growth and profit. Some manufacturers are already presenting themselves as “mobility solution providers”. They may also sell off or outsource their least strategic activities. This will benefit players who focus on size to reduce fixed costs and on productivity to reduce variable costs in order to offset the decline in their production value. Here, in the factories of industrialised countries, is where the issues of production automation and digitalisation (Industry 4.0) notably emerge, or where relocation rears its head once again as a real option (low wage costs, growing market for basic vehicles). However, the internalization of production and services and the ability to embrace an entire segment are an alternative to maintain the ability to capture value in the sector.

SUPPORTING ADAPTATION

These are recognized solutions; they are not new, but will probably intensify. We can see reasons to worry about employment in the sector’s traditional activities, but adaptation also opens up the way for new companies and new professions. The sector’s challenges can therefore be summarized as:

- less volumes and jobs in engine-related activities;

- more service-based and engineering activities;

- renewed contours of the automotive sector, opening up to other companies (with their jobs) and professions;

- new forms of organisation, work and skills.

This underlines the compelling need for companies and employees to head along a route without necessarily having the final point of equilibrium in view. The financial community is sanctioning uncertainty by focusing on other sectors and is deferring this uncertainty to society as a whole. In this context, employees are the ones required to consider professional, and sometimes geographical, mobility, difficult to instigate and which require support and initiatives to secure career paths. A subject which engages corporate responsibility and, more broadly, the public resources granted to the sector.

PARTNERSHIPS

In view of the car of the future, manufacturers and automotive suppliers are expanding their fields of expertise through partnerships. They are buying shares in leading vehicle for hire companies, for example (Lyft for GM, Uber for Daimler). Developments in future connected vehicles have given rise to alliances between Microsoft, Ericsson, Huawei and some manufacturers. For autonomous vehicles, VAG may partner with Waymo (ex-Google Car) and equity investments are being made in public transport, for example between French start-ups (Navya and EasyMile) and Valeo or Continental.