Automotive industry : the end of a cycle?

The end of 2018 saw very low growth in the global and European automotive sector with a lull in the second half of the year. We believe it’s important to distinguish between the causes of an economic slowdown and the structural factors of change in this sector. As we see it, this distinction is necessary to understand the threats, opportunities and challenges for automotive sector employees.

The European market has seen a strong rebound since 2014. Together with China, it is one of the main drivers of global growth. The slowdown in 2018 could eventually suggest the end of this growth cycle. The first half of the year confirmed good market performance with 4.5% increase in volumes, compared to 3% in previous years. This increase was notably supported by China (+5%), Europe (+4% excluding the UK) and a recovery in two of the main emerging countries, Brazil and Russia.

SLOWDOWN

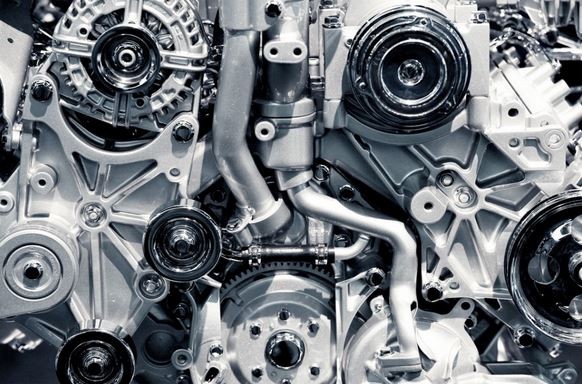

Nevertheless, 2018 ended with very low growth rates and two key areas do indeed seem to have stalled. Firstly, growth forecasts for China were revised and limited to +1.5% for 2018. This was largely due to household debt levels. Secondly, in Europe, under-performance since September has stifled growth according to the latest ACEA figures (with the European market expected to remain stable in 2019). There are two explanations: the new rules for vehicle approval (introduction of WLTP) and the new Euro 6d-temp emission standard which came into effect in September and imposes new equipment on the engine production line. These two factors boosted production before the transition to the new rules and standard, creating a cyclical slowdown thereafter.

Year end in the automotive sector is generally less dynamic, but the effects of these regulatory changes have meant the last quarter of 2018 was particularly weak. This also explains the announced move to short-time working hours for many, a cause for concern in companies and perhaps something you have experienced in your own workplace.

CONCERNS

In the medium-term, deeper concerns are putting industry players under pressure. This dip in growth has appeared at a time when several market players downwardly revised their revenue forecasts and saw their “market capitalisation” collapse in 2018. More than the cyclical downturn, one of the main reasons is the major investment effort made on key innovations (connected and autonomous vehicles) offering uncertain prospects for profitability in the short-term. This issue is at the very core of a reorganization of the sector which we will discuss in the following article. Several changes are at hand, but some industry players — manufacturers especially — have amplified the signals of these changes so as to exert pressure on the European Community while it was deciding on targets for reducing harmful emission levels. Ultimately, CO2 emissions from new cars will have to decrease by 37.5% by 2030 (compared to 2021).